Table of Content

Like the Federal Housing Authority, most Mississippi programs, you’re considered a first-time homebuyer if you haven’t owned a home in the past three years. Some of these programs call for 640 or above for a credit score. Make sure to get your credit in order before you apply for one of these programs, as this score may be higher than conventional mortgages.

Imagine you want to buy a home in Franklin County, Mississippi. Borrowers must complete an approved homebuyer education program. The property must be used as a primary residence and must be occupied by the owner. Your total annual family income must be below the income limit threshold for the county in which the residence is located.

Today's Mortgage Rates

You can also apply to the Mississippi Home Corporation down payment assistance program . You can, of course, apply to the Mississippi Home Corporation down payment assistance program . Home prices in the state are below the national average and are rising less quickly than in most other states. Mississippi does not require you to hire a real estate attorney to buy a home. However, depending on your circumstances, you might consider hiring one anyways. If you do, treat the process similarly to hiring an agent.

Note that government loan programs require you to buy a primary residence. That means you can’t use these loans for a vacation home or investment property. Your real estate agent will be your main ally during the home buying process. Besides finding and showing you properties, your agent will help you make offers, negotiate contracts, and navigate the closing process. Plus, they can recommend other service providers like title companies and inspectors to help you buy your home in Mississippi.

Mississippi first-time home buyer programs

Find AgentsIf you don't love your Clever partner agent, you can request to meet with another, or shake hands and go a different direction. We offer this because we're confident you're going to love working with a Clever Partner Agent. "The Fed is raising interest rates. What does that mean for borrowers and savers?."Accessed October 11, 2022.

The first step is to find a top local realtor who's an expert negotiator with proven experience in your market. The timing of your house hunt in Mississippi can have a big impact on your number of options. For example, in Mississippi, October has historically seen the most homes for sale. Searching in this season could give you more options and a greater likelihood of finding your dream home. Searching for homes in Mississippi is the fun part of the home buying process! You'll get to look at a variety of homes and discover what you really want in a home.

CREDITSCORES

Learn how to qualify for a mortgage in 2023 before working with a lender with our detailed overview of the minimum mortgage requirements by loan type. If you’re eligible for a USDA or VA loan, you won’t need to worry about providing a down payment. The minimum FHA down payment requirement is 3.5%, but if you take out a Smart Solution Second mortgage, you may be able to cover the down payment with the loan. Don’t just look at advertised rates online; actually apply for preapproval and compare the interest rates and fees you’re offered. That’s the only way to know you’re getting the best deal possible on your new home loan.

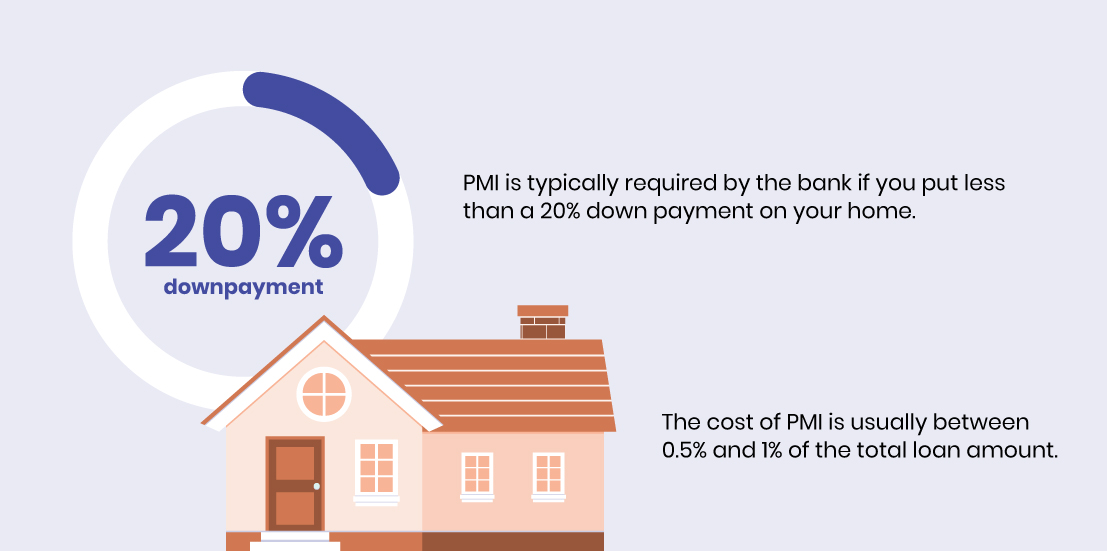

And you never have to pay for private mortgage insurance . Conventional loans require private mortgage insurance until your loan balance reaches 80% of the purchase price. FHA loans, on the other hand, require a mortgage insurance premium for the life of your loans. In Mississippi, an individual may qualify as a first-time homebuyer if he or she has not owned a home in the past three years as a primary residence. There are some exceptions to this, such as homeowners buying in federally designated Target Areas where incomes are typically low and some qualified veterans.

You can also experiment with a mortgage affordability calculator to determine your budget and to see how items like interest rate and down payment affect your monthly mortgage payment. After you finish the paperwork, you’ll pay off your closing costs. You'll simply pay the total amount to the title company, and then they’ll handle the distribution of the funds.

For the best results, let your agent take the lead, especially for crafting your offer. Their expertise in your local area will allow them to give you top-notch advice on how to make your offer strong while still keeping it a fair deal for you. In fact, you should compare interest rates and preapproval amounts from several lenders to make sure you're getting the absolute best terms when you buy your Mississippi home. MHC's Mortgage Revenue Bond 7 program provides a deferred 10-year second mortgage that can offer up to $7,000. It accrues no interest and it's forgivable after 10 years. First, because you're borrowing more money, you'll have a higher monthly payment and pay more in interest over the life of your loan.

Most first-time homebuyer programs in Mississippi require you to be approved for a mortgage from a recommended lender. While the MHC grants and forgivable loans will help pay for the closing costs and down payments, it is necessary to find an affordable mortgage loan to use them. While you can use a conventional mortgage, if you are concerned about qualifying for or affording one, several national programs are available to help low- to moderate-income homebuyers.

The median list price in Jackson, MS, was $150,000 in June 2022, according to Realtor.com. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here's how we make money.

Although there is no official minimum credit score, most VA-approved lenders require scores of at least 640. First-time homebuyers in the City of Jackson may be eligible for the City of Jackson Homebuyer Assistance Program. This program offers down payment assistance for low-to-moderate income households within the city limits of Jackson.

19, the committee will not only vote to approve its final report, but also on whether to make criminal referrals to the justice department as part of its probe. When it comes to holding anyone criminally responsible, the panel has not disclosed whom it might recommend for consideration. The panel’s full report will be released the same day as the meeting. Our team of industry-leading researchers are committed to making homeownership more accessible by educating buyers through guides like this one.

Many first-time homebuyers utilize FHA loans because of their lower credit score requirements and lower down payment requirements (3.5%). Note you will be required to pay two types of FHA mortgage insurance on the loans. These loans allow buyers to have a lower credit score, but you will need at least a 640 credit score to qualify for many Mississippi loans. It’s worth noting that in Mississippi, the FHA loan limit for a single-family home goes up to $420,680. The Mississippi Home Corporation offers multiple programs via participating lenders that first-time homebuyers can take advantage of. These programs include a tax credit, a forgivable second mortgage and a special program for teachers to bring teaching professionals into rural Mississippi.

No comments:

Post a Comment